Hire Best Offshore Tax Professionals

in under 4 Days.

Offshore tax professionals skilled in 1040, 1065, 1120, 1120S, and multi-state compliance.

Hire Best Offshore Tax Professionals

in under 4 Days.

Offshore tax professionals skilled in 1040, 1065, 1120, 1120S, and multi-state compliance.

Looking for tax-savvy pros to keep Uncle Sam happy?

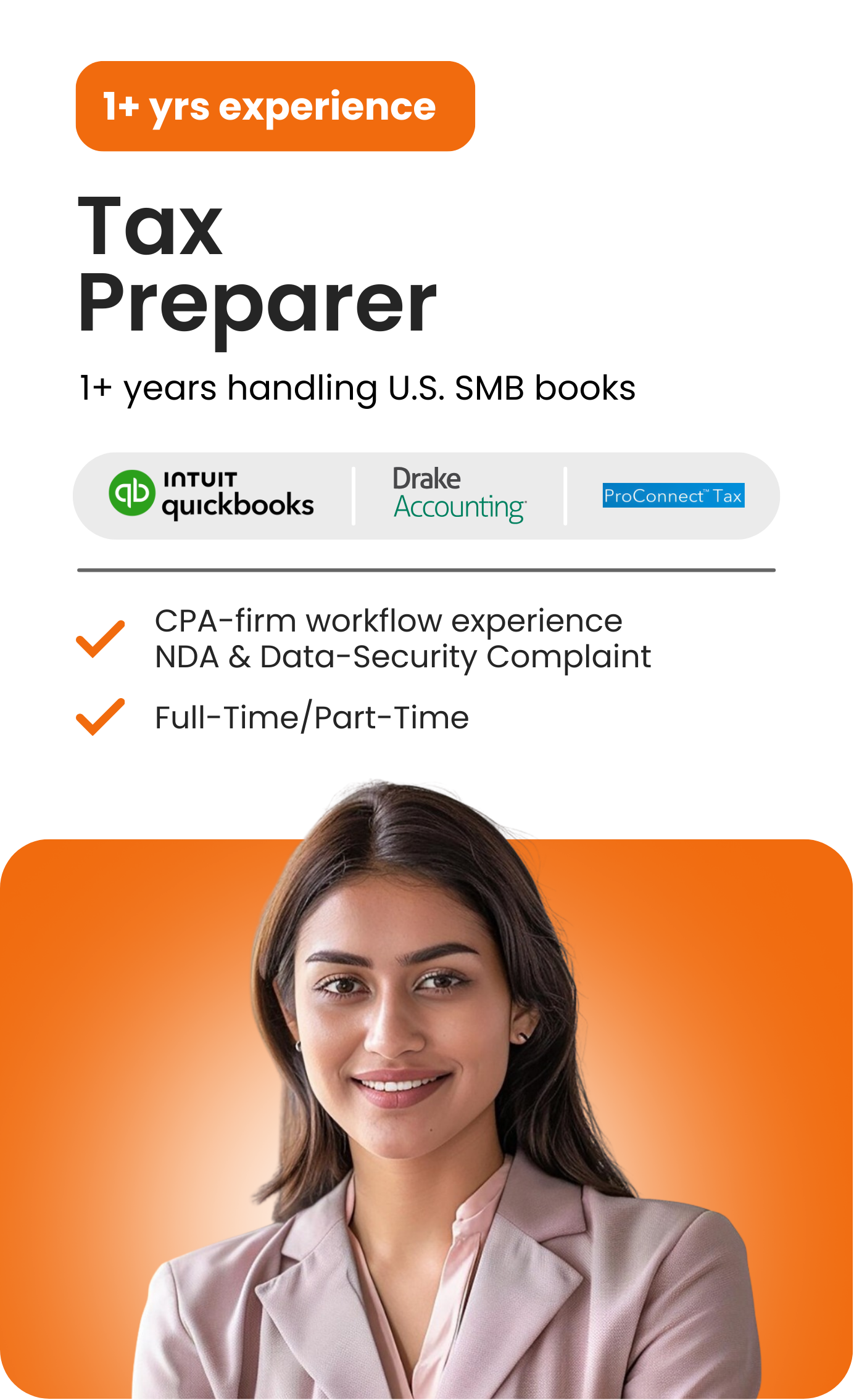

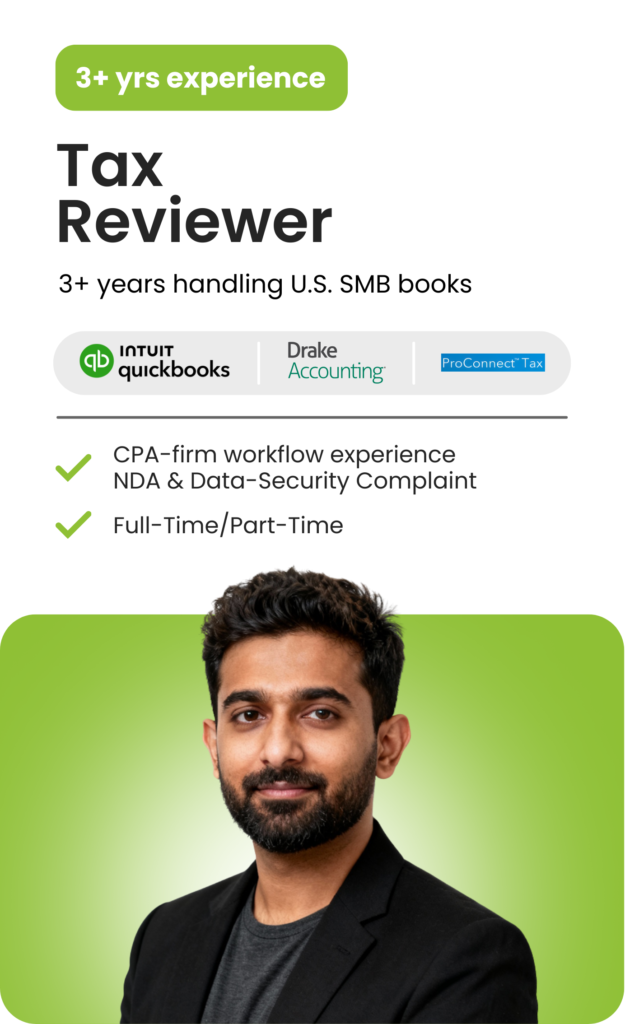

Whether you need a detail-obsessed Tax Preparer to crunch the numbers or a sharp-eyed Tax Reviewer to double-check every deduction, we’ve got the talent to keep you compliant and stress-free.

Share with us what you need, drop in your details, and we’ll take care of the rest. While we handle the tax pros, you can focus on growing your business, because let’s be real, you’ve got better things to do than wrestle with tax codes!

Start Interviewing Candidates & Onboard within 4 Days!

Why NBG

A Comparative View

Parameters

- Time to Productivity

- Management Overhead

- Recruitment Fees

- Benefits & Payroll Overhead

- Cost Predictability

- Capacity Elasticity

- Continuity Risk

- Onboarding Speed

- Replacement Support

NBG Staffing

- < 7 days

- Low

- Included

- Included

- High (fixed)

- High

- Low

- Immediate

- Structured

Other Offshore

- 10–20 days

- Medium

- Sometimes extra

- Included

- Medium

- Medium

- Medium

- Moderate

- Limited

Onshore Hiring

- 45–75 days

- High

- Applicable

- High

- Low

- Low

- High

- Slow

- Ad hoc

Parameters

- Time to Productivity

- Management Overhead

- Recruitment Fees

- Benefits & Payroll Overhead

- Cost Predictability

- Capacity Elasticity

- Continuity Risk

- Onboarding Speed

- Replacement Support

NBG Staffing

- < 7 days

- Low

- Included

- Included

- High (fixed)

- High

- Low

- Immediate

- Structured

NBG Staffing

- < 7 days

- Low

- Included

- Included

- High (fixed)

- High

- Low

- Immediate

- Structured

Other Offshore

- 10–20 days

- Medium

- Sometimes extra

- Included

- Medium

- Medium

- Medium

- Moderate

- Limited

Tax preparers are proficient in Drake, ProSeries, UltraTax, Lacerte, and CCH Axcess. They can work directly within your firm’s preferred platform via secure remote access.

Yes. They’re trained to handle 1040, 1065, 1120, 1120S, and Schedule C filings — including organizing source documents, calculating deductions, and flagging compliance risks.

Tax preparers undergo seasonal IRS update training, use AI-supported review tools, and follow firm-specific checklists for each return type. A senior tax reviewer checks high-complexity files before submission.

They review the accuracy of entries, validate supporting documents, ensure compliance with IRS guidelines, and cross-check deductions, credits, and carryforwards for risk or red flags.

Yes. They use built-in diagnostics in Drake, UltraTax, or ProSeries, along with firm-approved checklists for 1040, 1065, 1120, and 1120S. Reviewers also flag inconsistencies and prepare summary notes for final CPA sign-off.

Absolutely. Tax reviewers are experienced with layered review processes, handling batch reviews, prioritizing deadlines, and coordinating feedback loops with preparers and CPAs.

Start Interviewing Candidates & Onboard within 4 Days!

Book Your Free Staffing Consultation

Schedule a quick intro call to discuss your offshore accounting needs and find the best-fit talent for your firm.

Let's Staff, Let's Grow

Whether you need a dedicated bookkeeper, accountant, or a full offshore team, we’re here to help you scale smart, without compromising on quality or compliance.